In today’s digital era, e-invoicing solutions have become a vital tool for businesses of all sizes. It simplifies billing processes, enhances accuracy, and improves overall efficiency. Whether you’re a small business owner or managing a large corporation, adopting digital invoicing in Malaysia can bring remarkable benefits to your operations.

What is E-Invoicing?

E-invoicing refers to the electronic generation, transmission, and processing of invoices between businesses and their clients. Unlike traditional paper invoices, e-invoices are created digitally and can be shared instantly. In Malaysia, the government is actively promoting digital transformation among SMEs and large corporations, making e-invoicing more relevant than ever.

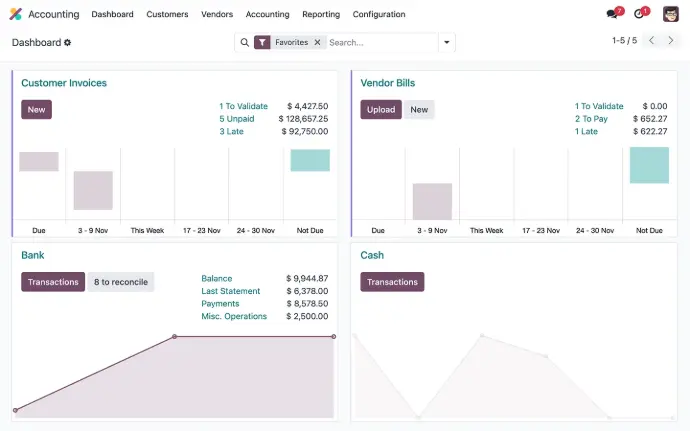

The adoption of Odoo e-invoicing integration enables businesses to stay compliant with tax compliance invoicing standards, ensuring that all invoices generated meet local regulatory requirements such as SST compliance for e-invoicing.

Benefits of E-Invoicing

* Cost Savings: Reduces paper, printing, and postage expenses, contributing to more sustainable operations.

* Efficiency: Speeds up the invoicing process, resulting in faster payments and better cash flow management.

* Accuracy: Minimizes errors with automated invoicing systems, ensuring correct calculations and reducing human errors.

* Environmental Impact: Promotes sustainability by eliminating paper waste through cloud-based invoicing systems.

Why Do You Need E-Invoicing?

Malaysian businesses need to adopt e-invoicing due to the government's push for greater transparency, efficiency, and compliance with tax regulations. The Inland Revenue Board (IRB) is implementing mandatory e-invoicing as part of the country's digital transformation agenda to enhance tax reporting and curb tax evasion.

COMPULSORY implementation dates for ALL Malaysian Tax Payers

August 1, 2024: Mandatory for businesses with an annual turnover of more than RM100 million

January 1, 2025: Mandatory for businesses with an annual turnover of more than RM25 million and up to RM100 million

July 1, 2025: Mandatory for all other businesses/ tax payers

E-invoicing ensures real-time submission of invoices to the IRB, reducing errors, improving record-keeping, and streamlining tax compliance processes. By embracing Odoo e-invoicing integration, businesses can not only meet regulatory requirements but also gain operational benefits, such as faster payments, reduced administrative costs, and a stronger competitive edge in a rapidly evolving digital economy.

Top 5 Most Important Points when choosing E-invoice solutions

1. Compliance with Malaysian Regulations

Ensuring your invoicing system adheres to local tax laws, such as SST (Sales and Service Tax), and meets requirements set by LHDN (Inland Revenue Board) is crucial. A compliant system will prevent costly penalties, simplify audit processes, and support government-mandated reporting requirements. E-invoice compliance ensures that all invoices are submitted digitally, improving the overall tax reporting process.

2. Cost Transparency

An ideal provider offers full transparency with no hidden costs, including free upgrades and no lock-in periods. This ensures you’re not tied to long-term commitments or subjected to surprise fees. Free upgrades allow your system to stay current without incurring additional expenses, while the flexibility of no lock-in periods lets you switch providers as your business evolves.

3. Integration with a Seamless and Single Platform

A modern e-invoicing solution should integrate smoothly with your ERP, CRM, and accounting systems, creating a unified and seamless platform. This eliminates redundant processes, enhances operational efficiency, and ensures data consistency across all your business tools. Businesses using ERP for e-invoicing benefit from a more streamlined invoicing process that connects seamlessly with other core business operations.

4. Data Security

Protecting sensitive financial and customer data is non-negotiable. Look for providers that offer end-to-end encryption, secure cloud storage, and compliance with international security standards, such as ISO 27001. A secure system will safeguard your business against data breaches and instill trust in your clients.

5. Reputation and Reliability

Choose a provider with a proven track record and positive reviews from other Malaysian businesses. A trusted provider is more likely to offer a robust and reliable platform, ensuring stability and ongoing support. Check if they are also trusted by multinational corporations, as this often signifies high standards of service.

E-invoicing is a simple way to save time, reduce costs, and stay ahead in a digital-first economy.

Key Points

1. What is E-Invoicing?

E-invoicing is the digital creation and sharing of invoices. It’s faster, more efficient, and error-free compared to paper invoicing. In Malaysia, it’s becoming essential due to the government’s push for digital transformation.

2. Why It’s Important for Malaysian Businesses

The IRB is rolling out mandatory e-invoicing to improve tax compliance and transparency. Businesses benefit from real-time submissions, fewer errors, faster payments, and cost savings while staying compliant with regulations.

3. Benefits of E-Invoicing

* Saves costs on paper, printing, and postage.

* Speeds up payment processes.

* Reduces errors through automation.

* Helps the environment by cutting down paper use.

4. How to Choose an E-Invoice Solution

* Ensure it complies with local tax laws (SST, IRB).

* Look for clear pricing with no hidden fees or long-term contracts.

* Choose one that integrates with your existing ERP or accounting systems.

* Prioritize security features like encryption and secure cloud storage.

* Pick a reliable provider with good reviews and a proven track record.